Managing debt is one of the most important financial skills you can master. Debt can weigh heavily on your financial health, and if left unmanaged, it can lead to stress, financial instability, and even a decline in creditworthiness. However, the good news is that you can take actionable steps to get out of debt and stay out for the long term.

In this article, we’ll explore practical steps for effective debt management, tips for staying debt-free, and answers to some frequently asked questions on this topic.

Understanding Debt: The First Step Towards Management

Before diving into how to get out of debt, it’s essential to understand the types of debt you have. Debt falls into two categories: good debt and bad debt.

What is Good Debt?

Good debt typically refers to loans that can help you build wealth in the future, such as student loans, mortgages, or business loans. While these types of debt come with their own risks, they generally offer the potential for higher returns.

What is Bad Debt?

Bad debt includes high-interest debt that doesn’t help build your wealth, such as credit card debt or payday loans. These types of debt are often a result of poor financial habits and can quickly spiral out of control if not managed properly.

Step 1: Assess Your Current Debt Situation

List All of Your Debts

The first step in tackling debt is to understand exactly how much you owe. Make a list of all your debts, including credit cards, student loans, car loans, mortgages, and any other outstanding balances. For each debt, note the amount owed, the interest rate, and the minimum monthly payment.

Example of Your Debt List:

- Credit Card 1: $2,000 at 18% APR

- Student Loan: $15,000 at 4% interest

- Car Loan: $8,000 at 6% interest

Why This Matters

Knowing your exact debt load helps you create a clear plan of attack. It’s crucial to get a realistic picture of how much you owe before you can take steps to pay it off.

Step 2: Create a Budget

Track Your Income and Expenses

A budget is an essential tool for debt management. It helps you track your spending, identify areas where you can cut back, and allocate more money to debt repayment. Start by tracking your income and monthly expenses.

How to Create a Simple Budget

- List your income: Include your salary, side income, etc.

- List your expenses: Track all monthly expenses, such as rent/mortgage, utilities, groceries, transportation, and entertainment.

- Identify areas to cut back: Look for non-essential expenses (e.g., dining out, subscriptions) that you can reduce or eliminate to free up more money for debt repayment.

Why This is Key

A budget is the foundation of your financial plan. It allows you to control where your money goes, ensuring that you are living within your means and can put extra funds towards reducing debt.

Step 3: Choose a Debt Repayment Strategy

There are several debt repayment methods, each with its own pros and cons. Two of the most popular strategies are the Debt Snowball Method and the Debt Avalanche Method.

Debt Snowball Method

The debt snowball method involves paying off your smallest debt first, regardless of the interest rate. Once that debt is paid off, you move on to the next smallest debt. This method provides a sense of accomplishment and motivation as you clear each debt.

How It Works:

- Step 1: Focus on paying off your smallest debt first while making minimum payments on other debts.

- Step 2: Once the smallest debt is paid off, apply the money you were using for that payment to the next smallest debt.

- Step 3: Continue this process until all debts are paid off.

Debt Avalanche Method

The debt avalanche method involves paying off the debt with the highest interest rate first. This method saves you the most money in interest payments over time, though it may take longer to see results compared to the snowball method.

How It Works:

- Step 1: Focus on paying off the debt with the highest interest rate first while making minimum payments on other debts.

- Step 2: Once the high-interest debt is paid off, move on to the next highest interest rate debt.

- Step 3: Continue until all debts are paid off.

Which Method is Right for You?

The debt snowball method works best for those who need motivation and want to see quick results. The debt avalanche method is ideal for those who want to minimize interest costs and are comfortable with a longer repayment timeline before seeing results.

Step 4: Cut Unnecessary Expenses

Identify Non-Essential Spending

To free up more money for debt repayment, take a closer look at your spending habits. Cutting unnecessary expenses can make a significant difference in your ability to pay off debt faster.

Areas to Consider Cutting:

- Dining out: Preparing meals at home can save you hundreds each month.

- Subscriptions: Cancel unused subscriptions (e.g., streaming services, gym memberships).

- Impulse Purchases: Avoid buying things on a whim that aren’t part of your essential needs.

Why Cutting Expenses Matters

Cutting back on discretionary spending allows you to allocate more of your income toward debt repayment. The more you can cut, the faster you can eliminate your debt.

Step 5: Consider Debt Consolidation or Refinancing

If you have multiple debts with high-interest rates, debt consolidation or refinancing might be a good option to simplify your payments and reduce interest costs.

Debt Consolidation

Debt consolidation involves combining multiple debts into one loan with a lower interest rate. This makes managing payments easier and can save you money on interest.

Refinancing

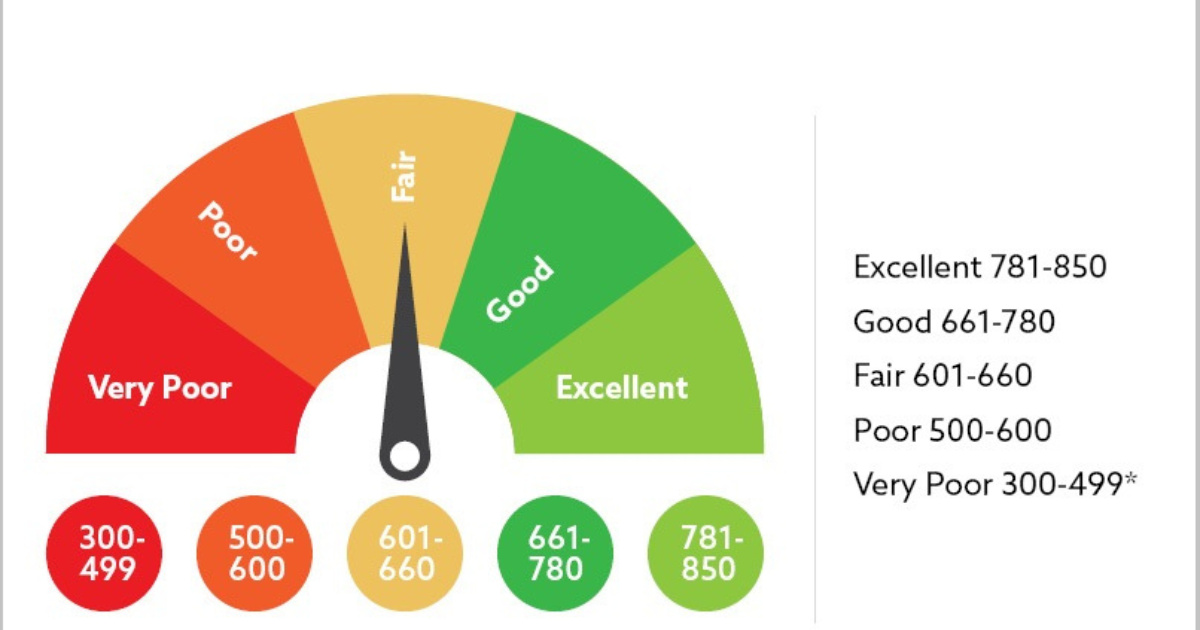

Refinancing involves taking out a new loan to pay off existing debts, often at a lower interest rate. This can be a good option if you have good credit and want to reduce the interest rate on your loans.

Why Consolidation and Refinancing Can Help

These options help reduce the complexity of managing multiple debts and can save you money on interest in the long run.

Step 6: Build an Emergency Fund

Why an Emergency Fund is Crucial

An emergency fund serves as a financial safety net, allowing you to cover unexpected expenses (e.g., medical bills, car repairs) without resorting to credit cards or loans. Having an emergency fund can prevent you from falling back into debt.

How Much Should You Save?

Aim for at least three to six months’ worth of living expenses in your emergency fund. Start small and build over time.

Why This Matters

An emergency fund provides financial security and prevents you from taking on more debt in the event of an unforeseen financial challenge.

Also Read : Real Estate Vs. Stock Market: Where Should You Invest?

Conclusion

Getting out of debt and staying out requires discipline, a clear plan, and the right mindset. By assessing your debt, creating a budget, choosing a debt repayment strategy, cutting unnecessary expenses, and building an emergency fund, you can make significant progress toward achieving financial freedom.

It’s important to remember that debt management is a process, and progress may be gradual. Stay consistent, celebrate small victories, and stay focused on your ultimate goal of becoming debt-free.

FAQs

1. How long will it take to pay off my debt?

The time it takes to pay off debt depends on the amount of debt, your income, and the strategy you use. Using the debt avalanche or snowball method can help accelerate the process.

2. Should I pay off high-interest debt first?

Yes, focusing on high-interest debt (using the debt avalanche method) helps you save money on interest and can reduce the time it takes to get out of debt.

3. Is it better to use debt consolidation or refinance?

Debt consolidation is a good option if you have multiple debts with high interest rates. Refinancing is ideal if you have existing loans and want to lower your interest rate.

4. How do I avoid falling back into debt after paying it off?

To avoid falling back into debt, create a solid budget, maintain an emergency fund, and commit to using credit responsibly. Avoid unnecessary purchases and be mindful of your spending habits.

5. Can I negotiate my debt with creditors?

Yes, many creditors are willing to work with you to adjust repayment terms or reduce interest rates, especially if you’re facing financial hardship. It’s worth reaching out to them for assistance.