College is a time of learning, growth, and discovery—but for many students, it’s also the first real test of financial independence. Between tuition, housing, textbooks, and social life, managing money in college can be overwhelming. Without proper financial literacy, students may fall into habits that lead to debt, poor credit, and financial stress.

In this guide, we’ll explore the essential components of financial literacy for students, why it matters, and how to build smart habits that can lead to long-term financial well-being.

What Is Financial Literacy?

Financial literacy is the ability to understand and use various financial skills, including budgeting, saving, investing, and managing debt. For college students, it means learning how to make informed decisions about money to maintain stability during school and beyond.

Why Financial Literacy Matters in College

- Promotes independence: Students learn how to budget and make financial decisions on their own.

- Prevents debt: Understanding credit, loans, and expenses can help avoid unnecessary debt.

- Builds habits early: Good financial behaviors formed in college can lead to lifelong stability.

- Supports academic success: Less financial stress often results in better focus and performance.

Budgeting: The Foundation of Financial Literacy

Budgeting is the cornerstone of financial success. Without a budget, it’s easy to overspend and underestimate expenses.

How to Create a College Budget

- Track your income

Include money from part-time jobs, allowances, scholarships, grants, and student loans. - List your expenses

Break them into fixed (rent, tuition, phone bill) and variable (food, entertainment, transportation). - Set spending limits

Allocate specific amounts for categories and stick to them. - Use budgeting tools

Apps like Mint, YNAB, or college-specific planners can help automate and visualize your spending.

Tips for Sticking to a Budget

- Review your budget weekly.

- Avoid impulse purchases.

- Use cash for discretionary spending.

- Prioritize needs over wants.

Understanding Student Loans and Credit

Many students finance their education with loans, but not all understand how repayment, interest, and credit scores work.

Student Loans: What to Know

- Federal vs. private: Federal loans typically have lower interest rates and more flexible repayment options.

- Interest accrual: Know when interest starts to accumulate—some loans begin during school, others after graduation.

- Grace periods: Understand how long you have before repayment begins.

Credit Cards in College

- Use wisely: Credit cards can help build credit if used responsibly.

- Pay in full: Avoid interest charges by paying your balance every month.

- Start with one: A student card or secured card can be a good entry point.

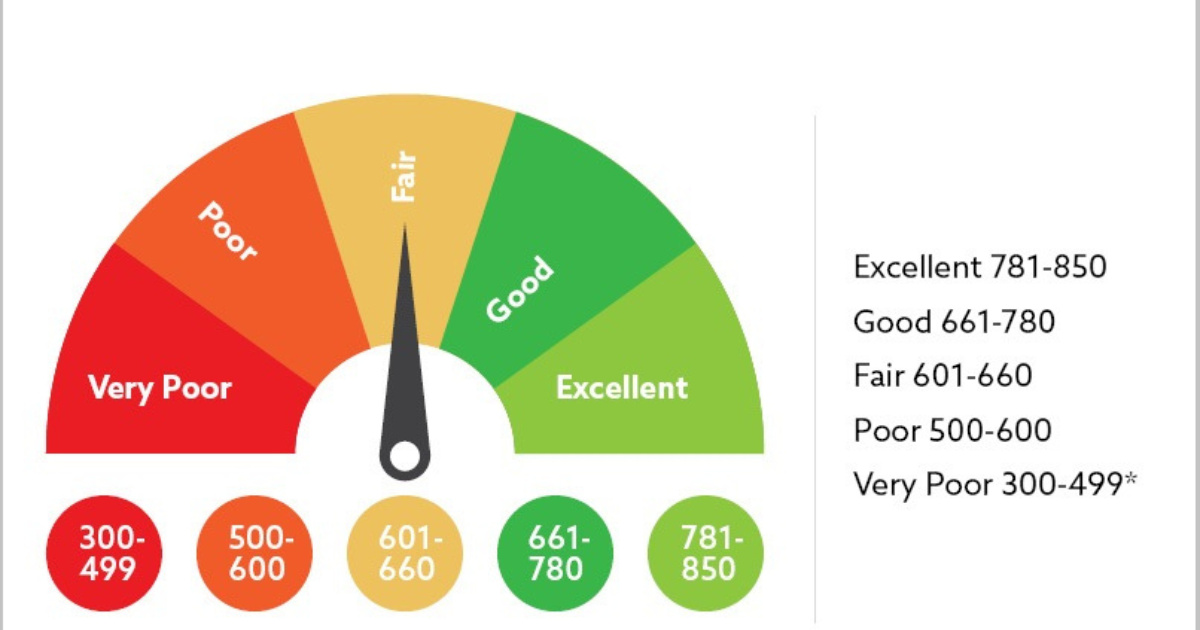

Understanding Credit Scores

- Affects your ability to rent an apartment, get a loan, or even a job.

- Based on payment history, credit usage, length of credit history, new credit, and types of credit.

Saving as a Student

Even on a tight budget, saving is essential. It builds discipline and prepares you for emergencies.

Why You Should Save in College

- Covers unexpected expenses (e.g., medical bills, car repairs).

- Helps with future plans (e.g., travel, moving costs, grad school).

- Teaches delayed gratification and money management.

Smart Ways to Save

- Set up a high-yield savings account.

- Use automatic transfers to move money from checking to savings.

- Save a percentage of income from part-time work or side gigs.

- Look for student discounts and avoid unnecessary spending.

Earning Money in College

Increasing income is often just as important as reducing expenses.

On-Campus Jobs

- Flexible hours and no commuting.

- Work-study options may reduce loan needs.

- Experience for your resume.

Freelancing or Side Gigs

- Writing, tutoring, design, or gig apps (UberEats, TaskRabbit).

- Time management is key—balance work and studies.

Internships

- Many are unpaid, but paid internships are increasing.

- Valuable experience and potential job offers after graduation.

Making Smart Spending Decisions

Every dollar counts in college. Understanding wants vs. needs and learning how to shop smart makes a big difference.

Tips for Smarter Spending

- Plan meals and limit takeout.

- Rent or buy used textbooks.

- Share subscriptions with roommates.

- Attend free campus events for entertainment.

Avoiding Financial Pitfalls

- Don’t overspend on credit cards.

- Avoid “lifestyle creep” (spending more as you earn more).

- Be cautious with buy-now-pay-later and payday loans.

Building Financial Habits That Last

Habits formed in college can shape your financial future. Start building a system now to carry into post-grad life.

Positive Financial Habits

- Check your bank account regularly.

- Set financial goals and track your progress.

- Review your spending monthly.

- Learn from financial mistakes instead of repeating them.

Investing Basics for Students

- Learn about investing early—even if you’re not ready to start.

- Use micro-investing apps like Acorns or Stash.

- Contribute to a Roth IRA if you have earned income.

Financial Resources for Students

Many colleges offer free financial education tools or support services.

Campus Resources

- Financial aid office: Help with understanding loans and grants.

- Career center: Job placement and internship advice.

- Counseling services: Support for money-related stress.

Online Tools and Apps

- Mint, PocketGuard, YNAB: Budgeting tools.

- Credit Karma, NerdWallet: Credit monitoring and financial advice.

- Federal Student Aid website: For info on FAFSA and loans.

Also Read : Emergency Funds Explained: Why You Need One And How To Build It

Conclusion

Financial literacy is not a subject most students are formally taught, but it’s one of the most critical life skills you’ll ever learn. By understanding the basics of budgeting, saving, credit, and debt management, you can make confident decisions that set you up for financial independence—not just in college, but for life. Start small, stay consistent, and remember: managing your money wisely now gives you more freedom and opportunity in the future.

FAQs

What is the most important financial skill for college students?

Budgeting is the most important skill—it teaches you how to track and control your money so you can make informed financial decisions.

Should students have a credit card?

Yes, if used responsibly. A credit card can help build credit history, but students must pay the balance in full and on time to avoid debt.

How much should I save as a college student?

Even small amounts matter. Aim to save 10% of your income, or set aside $20–$50 per month if you’re on a tight budget.

What is a good way to avoid student loan debt?

Apply for scholarships and grants, work part-time, attend a community college first, or consider in-state public schools to reduce costs.

Can I invest as a student?

Yes, but only after building an emergency fund and covering essential expenses. Consider beginner-friendly platforms with low minimums.