Mastering personal finance isn’t about making millions overnight—it’s about making informed decisions, setting realistic goals, and staying financially secure at every stage of life. Whether you’re a student, a young professional, starting a family, or nearing retirement, developing strong financial habits can provide stability and peace of mind.

This guide explores smart, actionable financial strategies tailored for various life stages, helping you build wealth, avoid debt traps, and live with financial confidence.

Why Personal Finance Matters

Managing your finances effectively means having control over your money—not the other way around. It helps you:

- Save for emergencies

- Avoid unnecessary debt

- Invest in your future

- Reduce stress and improve your quality of life

Now let’s break down the essentials by life stage.

Stage 1: Early Adulthood (Ages 18–25)

Laying the Financial Foundation

1. Create a Basic Budget

Use the 50/30/20 rule:

- 50% for needs (rent, food, transport)

- 30% for wants

- 20% for savings or debt repayment

Apps like Mint or YNAB can help you track expenses.

2. Build an Emergency Fund

Start with at least $500–$1,000. Aim to build it to cover 3–6 months of expenses.

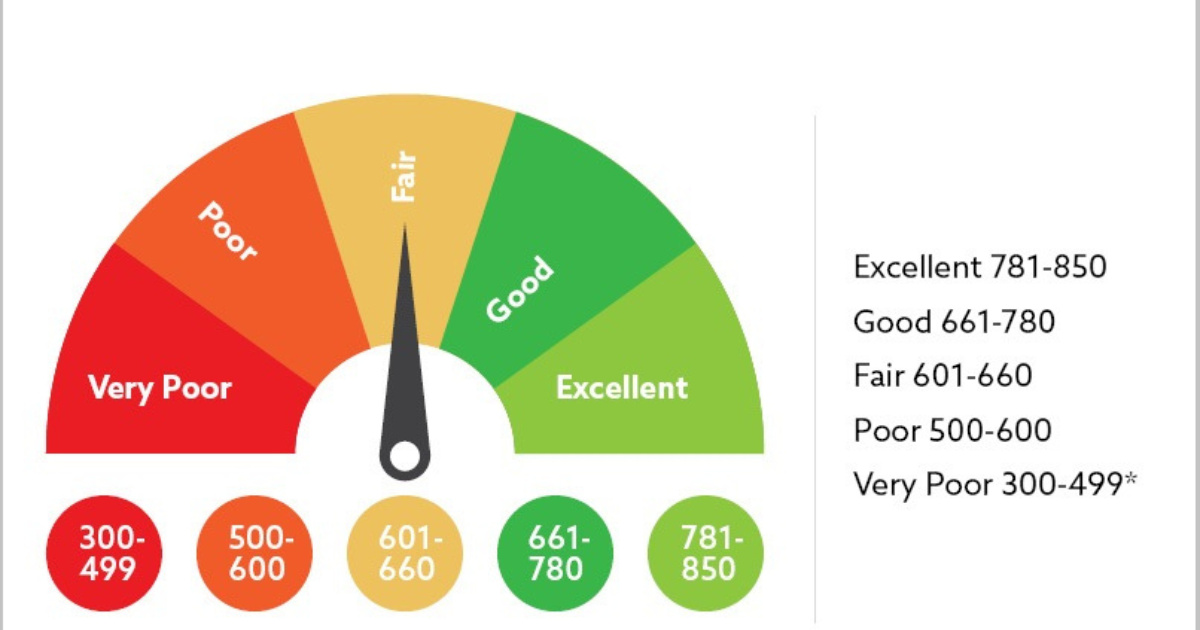

3. Understand Credit

Open a credit card, use it sparingly, and pay it off monthly. This builds your credit history, which is essential for future loans and renting apartments.

4. Learn Financial Literacy

Read beginner-friendly books like “Rich Dad Poor Dad” or follow personal finance blogs and YouTube channels.

Stage 2: Young Professionals (Ages 25–35)

Investing in Your Future

1. Maximize Retirement Accounts

If available, contribute to your employer-sponsored 401(k), especially if they offer a match. Open a Roth IRA for tax-free growth.

2. Manage Debt Wisely

Prioritize paying off high-interest debt like credit cards or private student loans. Consider refinancing if interest rates have dropped.

3. Start Investing

Open a brokerage account and begin with index funds or ETFs. Don’t try to time the market—invest consistently and think long-term.

4. Set Financial Goals

Want to buy a house? Travel? Start a business? Break your goals into short-, medium-, and long-term categories, and save accordingly.

5. Get Insurance

Life, health, disability, and renter’s insurance protect you from unexpected setbacks.

Stage 3: Building a Family (Ages 35–50)

Strengthening Financial Security

1. Reevaluate Your Budget

Children, mortgages, and healthcare increase your expenses. Adjust your budget regularly to reflect these changes.

2. Increase Emergency Savings

Now’s the time to have at least 6 months’ worth of expenses saved, especially if others depend on your income.

3. Save for Your Children’s Education

Start a 529 plan or other education savings account early. Compounding interest helps lessen the burden later.

4. Update Insurance and Estate Plans

Make sure you have adequate life insurance and an updated will. Consider creating a trust or assigning guardianship for your children.

5. Monitor Retirement Progress

Use online calculators to project retirement needs and adjust your contributions accordingly.

Stage 4: Peak Earning Years (Ages 50–65)

Preparing for Retirement

1. Max Out Retirement Contributions

Take advantage of catch-up contributions in 401(k)s and IRAs. At 50+, you’re allowed to contribute more annually.

2. Pay Off Major Debts

Aim to eliminate your mortgage, car loans, and credit card debt before retirement.

3. Reassess Your Investment Strategy

Shift gradually from high-risk to more conservative investments. Protecting capital becomes more important than aggressive growth.

4. Consider Long-Term Care Insurance

This can protect your savings from being depleted by future health needs.

5. Plan for Healthcare

Understand Medicare and other healthcare costs in retirement. Create a Health Savings Account (HSA) if eligible.

Stage 5: Retirement and Beyond (65+)

Managing Wealth in Retirement

1. Create a Retirement Withdrawal Plan

Use the 4% rule or other strategies to avoid outliving your savings. Work with a financial planner if needed.

2. Stay Active with Finances

Keep tracking expenses and income. Downsize or adjust spending habits if necessary.

3. Leave a Legacy

Consider charitable giving, passing wealth to heirs, or setting up trusts for grandchildren.

4. Stay Engaged

Volunteer, pursue hobbies, or even do part-time consulting. Financial health supports mental and emotional well-being too.

Essential Tools and Habits for All Ages

Budgeting Apps

- Mint

- YNAB (You Need a Budget)

- PocketGuard

Financial Planning Tools

- Personal Capital

- NerdWallet calculators

- Excel or Google Sheets templates

Regular Financial Checkups

Review your:

- Credit score (annually or quarterly)

- Budget (monthly)

- Investment portfolio (semi-annually)

- Financial goals (yearly)

Avoiding Common Mistakes

- Overspending on lifestyle inflation

- Ignoring debt

- Delaying retirement savings

- Investing without a plan

- Not having insurance

Conclusion

Mastering personal finance isn’t about perfection—it’s about consistency, planning, and adjusting as life changes. Whether you’re just starting out or planning retirement, the principles remain the same:

- Live below your means

- Save and invest wisely

- Protect your assets

- Keep learning and adapting

Every life stage brings its own financial challenges and opportunities. With the right mindset and strategy, you can confidently navigate each step and build lasting financial health.

FAQs

1. What’s the best way to start budgeting?

Start by tracking your expenses for one month. Use a budgeting app or spreadsheet and categorize everything. Then apply a simple method like 50/30/20 or zero-based budgeting.

2. How much should I have in my emergency fund?

Aim for 3–6 months of living expenses. If you’re self-employed or have dependents, consider saving even more.

3. When should I start investing?

As early as possible. The power of compound interest means the sooner you start, the more your money grows—even with small amounts.

4. Should I pay off debt or invest?

If the interest on your debt is higher than what you’d earn investing, pay off the debt first. Otherwise, you can often do both by splitting your funds.

5. Is it ever too late to start saving for retirement?

It’s never too late. Even starting in your 40s or 50s can make a difference with smart planning, catch-up contributions, and disciplined saving.