In the last two decades, digital banking and financial technology (fintech) have transformed the way we manage money, invest, and conduct business. With the rise of mobile applications, blockchain, AI, and real-time payments, the traditional banking model is rapidly evolving. As we move further into the 21st century, the convergence of technology and finance will continue to reshape the global economy.

In this article, we explore the emerging trends, technologies, and innovations driving the future of digital banking and fintech.

The Rise of Digital Banking

What is Digital Banking?

Digital banking refers to the digitization of traditional banking services through online platforms or mobile apps. This includes services such as:

- Account opening

- Deposits and withdrawals

- Loan applications

- Fund transfers

- Investment management

Unlike brick-and-mortar banks, digital banks (also known as neobanks) operate entirely online without physical branches.

Drivers of Digital Banking Growth

Several factors have fueled the rapid adoption of digital banking worldwide:

- Smartphone penetration: Over 6 billion smartphone users enable easy access to banking apps.

- Improved internet connectivity: High-speed internet allows for secure and seamless transactions.

- Changing consumer preferences: Customers now demand convenience, speed, and 24/7 service.

- COVID-19 pandemic: The crisis accelerated digital adoption due to lockdowns and contactless service needs.

Key Technologies Shaping the Future of Fintech

Artificial Intelligence (AI) and Machine Learning

AI is revolutionizing financial services in several ways:

- Fraud detection: AI systems can flag unusual patterns in real time.

- Chatbots and virtual assistants: Automate customer support and reduce costs.

- Personalized financial advice: Machine learning analyzes user behavior to suggest customized financial products.

Blockchain and Cryptocurrencies

Blockchain provides a decentralized, tamper-proof way to conduct transactions. It’s already impacting fintech through:

- Decentralized finance (DeFi) platforms

- Cryptocurrencies like Bitcoin and Ethereum

- Smart contracts that automate complex financial agreements

Blockchain offers improved transparency, faster cross-border payments, and lower transaction costs.

Biometric Security

With growing concerns about online fraud, biometric authentication is becoming a standard:

- Facial recognition

- Fingerprint scanning

- Voice recognition

These technologies enhance security and improve user convenience.

Open Banking and APIs

Open banking allows third-party developers to build applications and services around financial institutions. This is enabled by Application Programming Interfaces (APIs), allowing:

- Account aggregation

- Third-party payments

- Fintech partnerships with traditional banks

Open banking promotes innovation and increases competition in the financial ecosystem.

Neobanks and Challenger Banks: The New Norm?

Neobanks (fully digital banks) and challenger banks (tech-driven banks challenging traditional models) are rapidly gaining traction.

Features of Neobanks

- No physical branches

- App-based services

- Lower fees

- User-friendly interfaces

- Quick onboarding and KYC processes

Popular examples include Revolut, Chime, N26, and Monzo.

Why Are Customers Choosing Neobanks?

- Convenience: Access banking anytime, anywhere

- Cost-efficiency: No hidden fees

- Customization: More control over account settings

- Transparency: Clear breakdowns of spending and fees

The Future of Payment

Contactless and Mobile Payments

Contactless technologies such as NFC, QR codes, and digital wallets (Apple Pay, Google Pay, etc.) are replacing physical cards and cash.

Benefits include:

- Speed and convenience

- Enhanced hygiene (especially post-COVID)

- Improved security with tokenization

Real-Time Payments (RTP)

Real-time payments are transforming how money moves:

- Instant transfer of funds between accounts

- No waiting period or batch processing

- Useful for payroll, invoicing, and P2P payments

Countries like India (UPI), the UK (Faster Payments), and the US (FedNow) are adopting RTP systems.

Financial Inclusion Through Technology

One of the most powerful promises of digital banking and fintech is increasing financial inclusion, especially in underserved and remote areas.

How Fintech Promotes Inclusion

- Mobile banking apps reach customers in areas without traditional bank branches.

- Digital wallets enable users to save, send, and receive money with just a smartphone.

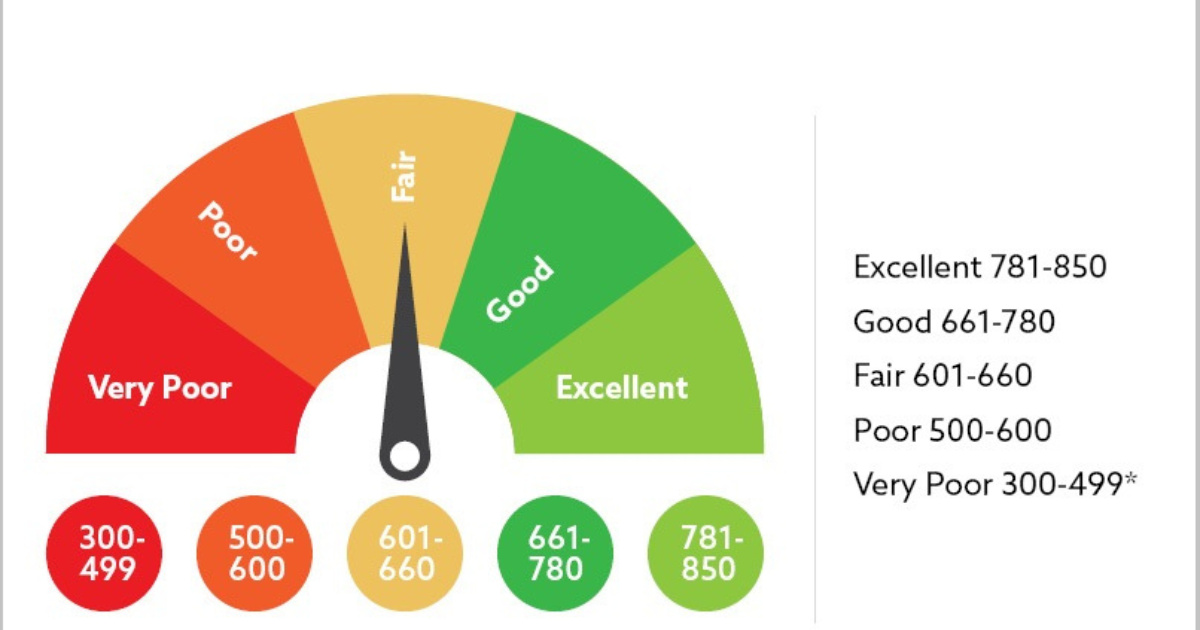

- Microloans and credit scoring using alternative data help people with no credit history gain access to financing.

Examples of Success

- M-Pesa in Kenya: Revolutionized mobile payments and banking.

- Paytm in India: Brought digital wallets to rural populations.

- Latin American fintechs: Address the needs of unbanked users in countries like Brazil and Mexico.

Regulatory and Compliance Challenges

With innovation comes responsibility. Governments and financial regulators are working to ensure fintech companies maintain customer safety and systemic stability.

Key Issues

- Data privacy: Protecting customer data under laws like GDPR and CCPA.

- AML/KYC compliance: Preventing money laundering and terrorism financing.

- Cybersecurity: Ensuring platforms are secure against threats and breaches.

The Role of Central Banks and Governments

Many governments are:

- Launching regulatory sandboxes

- Updating outdated banking laws

- Considering Central Bank Digital Currencies (CBDCs)

The Role of Central Bank Digital Currencies (CBDCs)

CBDCs are digital versions of a country’s currency issued by central banks. Unlike cryptocurrencies, CBDCs are centralized and regulated.

Benefits of CBDCs

- Enhance financial inclusion

- Improve monetary policy implementation

- Facilitate faster and safer payments

Countries like China (Digital Yuan) and India (e₹) are piloting CBDC programs, while others explore the concept.

Investment and Wealth Management in the Digital Era

Robo-Advisors

Automated investment platforms like Betterment and Wealthfront use algorithms to manage portfolios based on user preferences, risk tolerance, and goals.

Advantages:

- Lower fees than human advisors

- Accessible to all income levels

- Automated rebalancing and tax-loss harvesting

Fractional Investing

New platforms allow users to invest in fractional shares, making it easier to invest in high-value assets like:

- Blue-chip stocks (Amazon, Tesla)

- Real estate

- Art and collectibles

This trend democratizes investing for younger and less affluent users.

The Role of Big Tech in Fintech

Tech giants like Google, Apple, Amazon, and Facebook (Meta) are entering financial services through:

- Payment gateways (Apple Pay, Google Pay)

- Credit cards and loans

- E-commerce payment integrations

- Digital wallets and BNPL (Buy Now, Pay Later)

Their large user bases, data, and tech infrastructure give them an edge, raising both opportunities and regulatory concerns.

The Ethical and Social Implications

As fintech and digital banking evolve, it’s crucial to consider ethical dimensions:

Digital Divide

- Those without smartphones or internet access may be excluded.

- Older populations may struggle with digital-only services.

Algorithmic Bias

- AI models may reflect or amplify societal biases.

- Fintech companies must ensure transparency and fairness in lending, scoring, and support.

Data Exploitation

- Sensitive financial data can be misused for targeted advertising or sold to third parties.

What the Next Decade Might Look Like

By 2035, the financial landscape could be radically different:

- Hyper-personalized banking using AI and big data

- Seamless cross-border transactions with blockchain

- Digital IDs replacing traditional paperwork

- Invisible banking integrated into IoT devices and smart assistants

Banks will no longer be physical spaces but digital ecosystems that integrate with our daily lives.

Also Read : Understanding Credit Scores: What They Are and How to Improve Yours

Conclusion

The future of digital banking and financial technology is fast-paced, disruptive, and full of possibilities. While we’ve already seen impressive advancements, the coming years promise even more significant changes in how we interact with money. As innovations like AI, blockchain, open banking, and CBDCs mature, they will continue to drive efficiency, accessibility, and customer-centricity in financial services.

However, this transformation must be accompanied by robust regulation, ethical oversight, and a focus on inclusion. The institutions that adapt quickly, embrace innovation responsibly, and prioritize the customer experience will thrive in the digital age of finance.

Frequently Asked Questions (FAQs)

What is the difference between fintech and digital banking?

Fintech refers to all technological innovations in financial services, including lending, payments, investing, insurance, and more. Digital banking is a subset of fintech focused on digitizing traditional banking services.

Are digital banks safe?

Yes, most digital banks use robust encryption, two-factor authentication, and regulatory compliance to ensure customer security. Always verify that a digital bank is licensed and insured in your country.

Will traditional banks disappear?

Unlikely. Traditional banks are evolving and often adopting fintech tools themselves. The future will likely see hybrid models combining digital convenience with trusted banking infrastructure.

What is open banking?

Open banking allows third-party apps and developers to access bank data (with customer consent) through APIs. This encourages innovation and better financial products for consumers.

What are neobanks, and how are they different from traditional banks?

Neobanks are fully digital banks without physical branches. They offer banking services via mobile apps or websites and typically provide lower fees, faster onboarding, and better user experiences compared to traditional banks.