Entering the world of investing can feel overwhelming, especially with constant market shifts, emerging technologies, and complex financial jargon. But with the right strategies, 2025 can be the year you confidently take charge of your financial future. This guide breaks down 10 smart investment tips tailored for beginners—helping you build wealth, manage risk, and avoid common pitfalls.

Whether you’re saving for retirement, creating passive income, or pursuing financial independence, these tips will serve as a strong foundation.

Why Investing Is Essential in 2025

In today’s economy, inflation, digital transformation, and uncertain job markets make it more crucial than ever to grow your money. Relying on savings accounts alone won’t cut it. Investing allows your money to work for you, making it easier to achieve long-term financial goals.

Tip #1: Start with Clear Financial Goals

Why Goals Matter

Before investing, define what you’re investing for. Clear goals help determine your strategy, timeline, and risk tolerance.

Common Investment Goals

- Short-term (1–3 years): Vacation fund, emergency buffer

- Medium-term (3–7 years): Down payment, business startup

- Long-term (7+ years): Retirement, children’s education, financial freedom

Your time horizon influences whether you invest conservatively or aggressively.

Tip #2: Build an Emergency Fund First

Don’t Invest Without a Safety Net

Before you commit any money to investments, secure an emergency fund. This financial cushion protects you in case of job loss, medical emergencies, or unexpected expenses.

Where to Store Emergency Funds

- High-yield savings accounts

- Money market accounts

- Short-term certificates of deposit (CDs)

Aim for 3–6 months of living expenses in easily accessible funds.

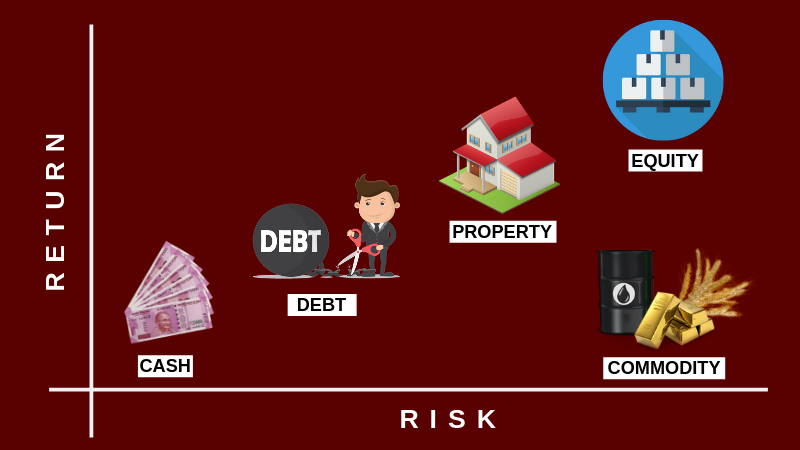

Tip #3: Learn the Basics of Asset Classes

Understand What You’re Investing In

Knowing the types of investments helps you make informed decisions and build a diversified portfolio.

Key Asset Classes

- Stocks: Shares of a company; high growth, high risk

- Bonds: Debt instruments from governments or corporations; lower risk, stable income

- Real Estate: Property or REITs; long-term appreciation and income

- ETFs and Mutual Funds: Diversified baskets of assets managed professionally

- Cryptocurrency: Digital assets like Bitcoin; highly volatile and speculative

Start with low-cost index funds or ETFs to gain broad exposure and minimize fees.

Tip #4: Take Advantage of Tax-Advantaged Accounts

Make Your Money Work More Efficiently

Tax-advantaged investment accounts help you grow your money faster by reducing or deferring taxes.

Popular Account Types

- 401(k): Employer-sponsored, often with matching contributions

- Traditional IRA: Tax-deductible contributions, taxed at withdrawal

- Roth IRA: Contributions taxed now, but withdrawals are tax-free

- HSA: Tax-deductible contributions, tax-free growth and withdrawals for healthcare

Maximize contributions to these accounts whenever possible.

Tip #5: Start Small but Start Now

The Power of Compounding

Investing small amounts consistently over time yields big results thanks to compound interest.

For example, investing just $100 per month at a 7% return grows to over $120,000 in 30 years.

Use Micro-Investing Apps

Apps like Acorns or Stash allow you to invest spare change or start with as little as $5.

Tip #6: Automate Your Investments

Make Investing a Habit

Automation removes emotion and inconsistency from your investment process.

How to Automate

- Set up recurring transfers from your bank account

- Use employer payroll deductions for 401(k)

- Enable auto-invest features on brokerage platforms

You’ll never forget or hesitate to invest—even during market volatility.

Tip #7: Diversify Your Portfolio

Spread Your Risk

Diversification protects you from severe losses by investing across different asset classes, sectors, and geographies.

Sample Diversification

- 60% stocks (domestic and international)

- 30% bonds or fixed-income assets

- 10% real estate, commodities, or alternatives

Diversified portfolios are more resilient and reduce volatility.

Tip #8: Avoid Timing the Market

Stay the Course

Trying to predict market highs and lows usually leads to poor decisions and missed gains.

Stick with Dollar-Cost Averaging

Invest a fixed amount regularly—regardless of market conditions. Over time, this lowers your average cost per share and reduces emotional investing.

Tip #9: Educate Yourself Continuously

Stay Financially Informed

Financial markets evolve. Learning continuously empowers you to make better decisions.

Learning Resources

- Books like The Intelligent Investor or I Will Teach You to Be Rich

- Podcasts such as BiggerPockets, Planet Money, or The Ramsey Show

- YouTube channels and blogs focused on personal finance and investing

Never stop learning—the more you know, the better you’ll grow your wealth.

Tip #10: Avoid Common Investment Mistakes

Be Mindful of Pitfalls

Avoiding rookie mistakes is just as important as knowing what to do.

Mistakes to Watch Out For

- Investing without a plan

- Chasing “hot” stocks or trends

- Not reviewing your portfolio regularly

- Ignoring fees and taxes

- Letting fear or greed guide decisions

Successful investing is a long game—focus on patience, consistency, and strategy.

Also Read : Mastering Personal Finance: Smart Strategies For Every Stage Of Life

Conclusion

Investing in 2025 presents exciting opportunities—but also new challenges. The key to success as a beginner is starting early, staying consistent, and building a strong foundation through education and discipline.

By following these 10 investment tips, you’ll avoid costly mistakes, make informed decisions, and set yourself up for long-term financial success. Remember: you don’t have to be wealthy to invest—but you have to invest to become wealthy.

FAQs

What’s the best investment for a beginner?

Low-cost index funds or ETFs are ideal because they offer diversification, low fees, and steady long-term growth without needing to pick individual stocks.

How much money do I need to start investing?

You can start with as little as $5 using micro-investing platforms, but $100–$500 is a great range to begin building a more diversified portfolio.

Should I invest if I still have debt?

If you have high-interest debt (like credit cards), pay that off first. If your debt has low interest (like federal student loans), you can often invest and pay down debt simultaneously.

Is it safe to invest in cryptocurrency?

Crypto can be a part of a diversified portfolio, but it’s highly volatile. Only invest what you’re willing to lose, and do thorough research beforehand.

How do I choose a brokerage account?

Look for low fees, ease of use, educational resources, and automation features. Popular beginner-friendly platforms include Fidelity, Vanguard, Charles Schwab, Robinhood, and Webull.