In today’s financial world, your credit score plays a significant role in shaping your economic life. Whether you’re applying for a credit card, purchasing a home, or leasing a car, your credit score can affect your approval odds, interest rates, and more. Despite its importance, many people don’t fully understand how credit scores work or how to improve them.

This article will break down what a credit score is, why it matters, how it’s calculated, and actionable tips to boost your credit score.

What is a Credit Score?

A credit score is a three-digit number that reflects your creditworthiness, or how likely you are to repay debt. It gives lenders a quick snapshot of your financial behavior, helping them determine the risk of lending you money.

Types of Credit Scores

- FICO Score: The most widely used credit score in the U.S., ranging from 300 to 850.

- VantageScore: Another common scoring model, also on a 300–850 scale.

- Industry-Specific Scores: These are used for auto loans or credit cards and may range up to 900.

Why Credit Scores Matter

Credit scores affect your financial life in many ways. Here’s how:

Lending Decisions

Lenders use your credit score to decide whether to:

- Approve your loan or credit application

- Set your interest rate

- Determine your credit limit

Housing

- Landlords may check your credit before renting you an apartment.

- Mortgage lenders use it to approve or deny your loan.

Employment

Some employers check credit reports (not scores) as part of their hiring process, especially in financial or government sectors.

Insurance Premiums

In many states, insurance companies use a version of your credit score to set premiums.

How Credit Scores Are Calculated

Credit scoring models like FICO and VantageScore calculate scores using several key factors.

FICO Score Breakdown

| Factor | Weight (%) | Description |

|---|---|---|

| Payment History | 35% | Timely payments on credit accounts |

| Amounts Owed (Credit Usage) | 30% | Total debt relative to available credit |

| Length of Credit History | 15% | How long accounts have been active |

| Credit Mix | 10% | Variety of credit accounts (loans, cards, etc.) |

| New Credit | 10% | Recent applications for new credit |

VantageScore Model Differences

VantageScore puts more emphasis on total debt and recent credit behavior but uses similar overall categories.

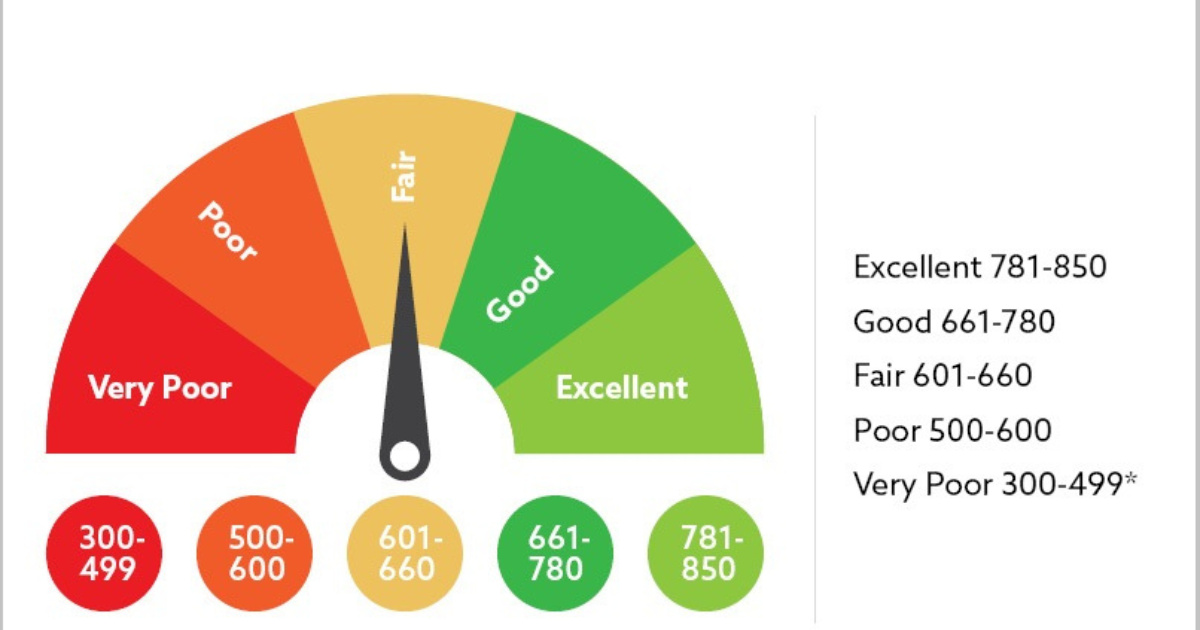

What is a Good Credit Score?

| Score Range | Category | Description |

|---|---|---|

| 800–850 | Exceptional | Excellent financial management, lowest risk to lenders |

| 740–799 | Very Good | Above average borrower |

| 670–739 | Good | Average borrower |

| 580–669 | Fair | Subprime borrower; may face higher interest rates |

| 300–579 | Poor | High risk; likely to be denied credit |

How to Check Your Credit Score

Free Methods to Check Your Score

- Credit Card Providers: Many banks and card issuers offer free FICO or VantageScore updates.

- Credit Bureaus: Equifax, Experian, and TransUnion offer limited access.

- Apps: Credit Karma, Credit Sesame, Mint.

Your Credit Report

Under U.S. law, you can access your credit report for free annually from each bureau via AnnualCreditReport.com. Note: Reports show data, but not your score (some sites include scores for free).

How to Improve Your Credit Scor

Improving your score takes time and discipline, but it’s achievable with these key strategies.

1. Pay Your Bills on Time

Late payments seriously damage your score. Set up:

- Payment reminders

- Auto-pay for loans and cards

Even one 30-day late payment can cause a significant drop.

2. Keep Credit Utilization Low

Credit utilization is your balance-to-limit ratio. Keep it below 30%, ideally under 10%.

- Example: If your credit limit is $10,000, keep your balance under $3,000.

- Pay down balances before the statement date if possible.

3. Don’t Close Old Accounts

Older accounts help build a longer credit history. Keep them open unless they have:

- High annual fees

- No real benefit

4. Limit Hard Inquiries

Each credit application triggers a hard inquiry, which can lower your score slightly.

- Don’t apply for multiple credit cards in a short time.

- Rate shopping for mortgages and auto loans within a short window (usually 14–45 days) counts as one inquiry.

5. Diversify Your Credit Mix

Having both revolving (credit cards) and installment accounts (loans) can boost your score.

- Example: A credit card + student loan + auto loan = good mix.

6. Check Your Credit Report for Errors

Mistakes can hurt your score. Look for:

- Accounts you didn’t open

- Incorrect balances or payment history

- Wrong addresses or names

Dispute errors directly with the credit bureaus.

7. Become an Authorized User

Ask a family member with a good credit history to add you as an authorized user. Their positive payment history can benefit your score.

Common Myths About Credit Scores

Myth 1: Checking Your Score Lowers It

Truth: A personal check is a soft inquiry and does not impact your score.

Myth 2: Income Affects Your Score

Truth: Income is not factored into your credit score.

Myth 3: You Need to Carry a Balance

Truth: You don’t need to carry a balance to build credit. Paying in full is better.

Myth 4: Closing a Card Will Boost Your Score

Truth: Closing a card may shorten your credit history and increase your utilization rate.

Credit Scores for Different Life Stages

Students and Young Adults

- Start with a student credit card or secured card.

- Become an authorized user on a parent’s card.

Mid-Career Adults

- Diversify credit mix with mortgages, auto loans, and personal loans.

- Monitor utilization and keep old accounts open.

Seniors and Retirees

- Keep at least one credit card active.

- Maintain good credit for medical emergencies or downsizing.

How Long Does It Take to Improve a Credit Score?

Short-Term (1–3 Months)

- Dispute errors

- Pay down credit card balances

- Stop applying for new credit

Mid-Term (3–6 Months)

- Build consistent payment history

- Reduce utilization below 10%

Long-Term (6–12 Months+)

- Maintain low balances

- Avoid late payments

- Increase credit limits

The impact of each action depends on your starting point and financial habits.

Tools to Help You Manage Credit

Credit Monitoring Services

- Identity theft alerts

- Score tracking

- Fraud detection

Budgeting Apps

- Mint

- YNAB (You Need A Budget)

- PocketGuard

Debt Management Programs

Non-profit credit counselors can help you create a plan to manage and pay down debt.

Also Read : How To Build A Budget You Can Actually Stick To

Conclusion

Understanding and managing your credit score is a critical part of financial health. A good credit score opens doors to better loan rates, higher approval chances, and even job opportunities. By knowing how your score is calculated and taking smart, proactive steps—like paying on time, reducing debt, and monitoring your credit—you can build and maintain a score that works for you, not against you.

Improving your credit isn’t just about numbers—it’s about gaining financial freedom and confidence. Start small, stay consistent, and your credit will reflect your efforts over time.

FAQs

1. How often is my credit score updated?

Credit scores are typically updated every 30 to 45 days when lenders report new information.

2. What’s the fastest way to raise my credit score?

Paying down high credit card balances and ensuring all bills are paid on time can provide the fastest improvements.

3. Can I build credit without a credit card?

Yes, through personal loans, student loans, or rent reporting services like Experian Boost.

4. What happens if I miss a payment?

Late payments can stay on your report for up to 7 years and significantly drop your score, especially if over 30 days late.

5. Does checking my credit report hurt my score?

No. Checking your own credit report is a soft inquiry and doesn’t impact your score.

6. How long do negative items stay on my credit report?

Most negative marks stay for 7 years, while bankruptcies may remain for up to 10 years.

7. Can I remove a collection from my report?

If it’s an error, you can dispute it. Otherwise, you can ask for a goodwill deletion after payment, though success varies.